January 30th, 2024

Let’s come together to fix the economy and heal our planet, because it’s time for the people to lead the way towards a brighter future!

Continue Reading

November 15th, 2023

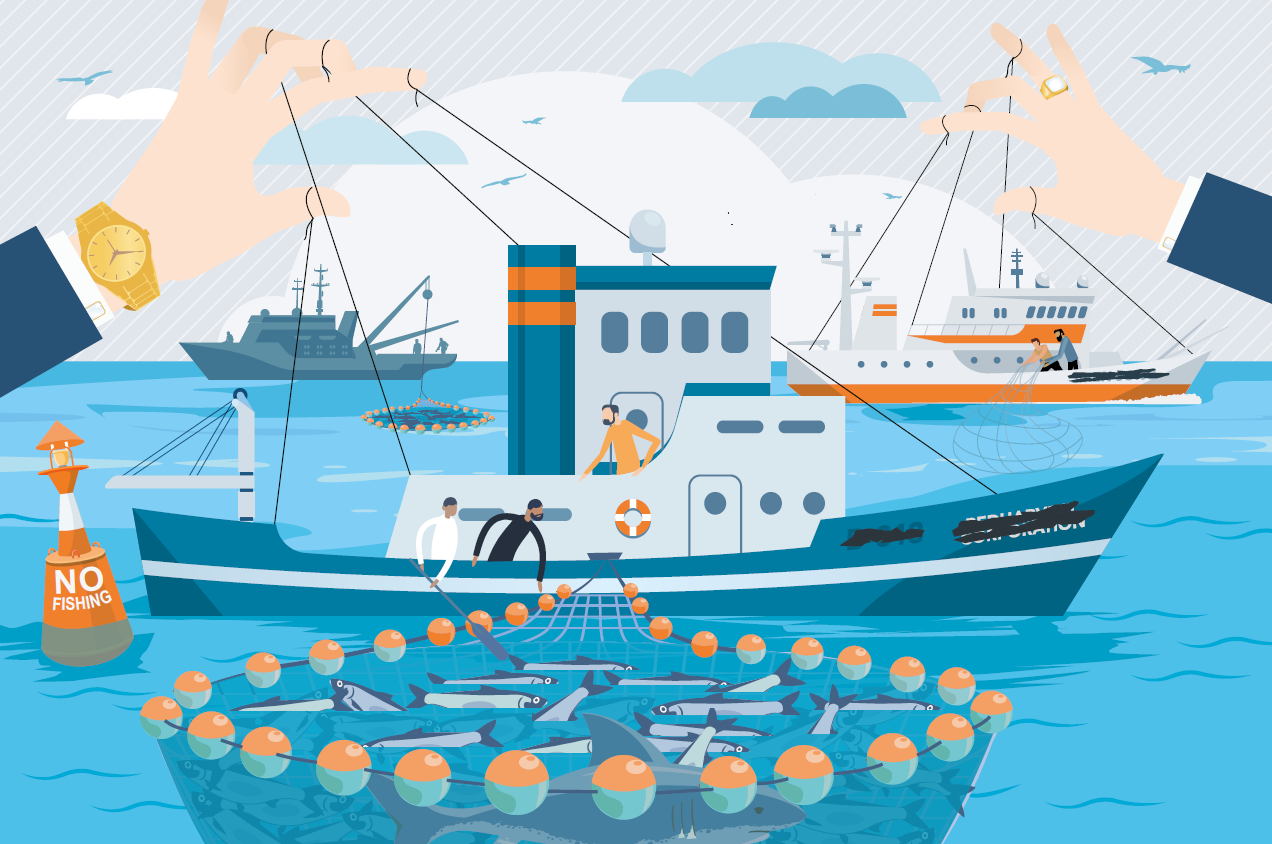

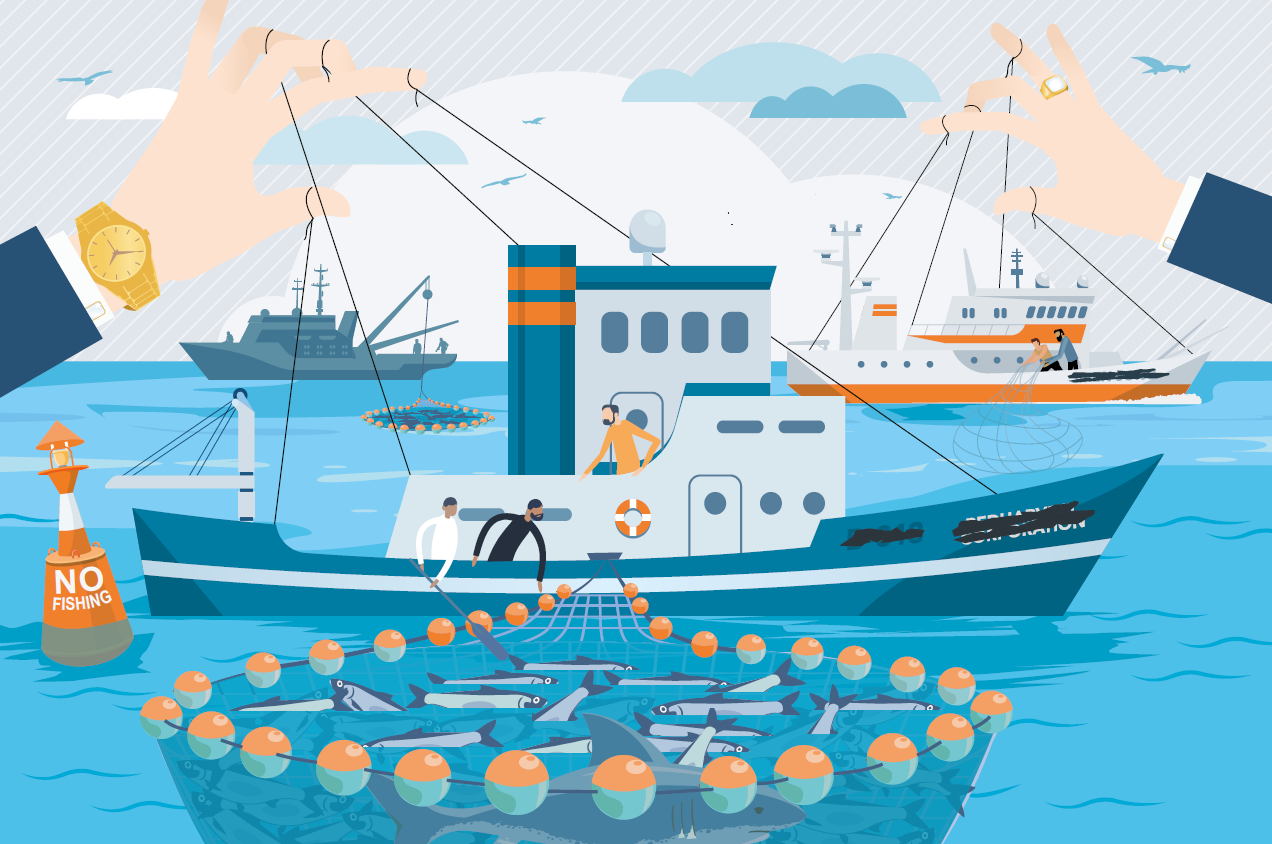

Lea el resumen ejecutivo. Lea el informe completo en inglés. Lea reportaje en IPS / Infobae / Pagina12 LONDRES – El 22,5% de los buques pesqueros industriales y semiindustriales acusados de trabajo forzoso eran propiedad de empresas europeas, encabezadas por empresas españolas, rusas y británicas, según un nuevo informe de la Coalición para la Transparencia Financiera,

Continue Reading

November 23rd, 2022

The Financial Transparency Coalition (FTC) and its members are alarmed and disappointed by the decision by the European Court of Justice (ECJ) published on November 22

Continue Reading

November 22nd, 2022

La Coalición para la Transparencia Financiera (FTC) y Fundación SES se complacen en invitarlo a un evento virtual el miércoles 30 de noviembre de 2022 de 14:00 a 15:30 UTC con traducción simultánea inglés-español.

Continue Reading