Will Dutch presidency fight for a more transparent Europe?

January 21st, 2016

January 21st, 2016

When most people think of the Netherlands, what may first come to mind are charming canal-side towns filled with people riding bicycles amid tulip fields and windmills.

But the Netherlands is much more than windmills and tulips.

The country is considered to be one of the world’s largest financial centers, and ranks 18th globally, according to the World Bank and the International Monetary Fund (IMF).

At the beginning of January, the Netherlands took over the Presidency of the Council of the European Union. It will hold this position until June 30 of this year, during which time its duties will include “driving forward the Council’s work on EU legislation” and “ensuring the continuity of the EU agenda.” And all while maintaining a neutral stance and fostering cooperation between EU member states.

But acting as a neutral force may be easier said than done, especially when national interests come into play. In the case of the Netherlands’ presidency, there are various complications on the horizon, most notably the fact that in recent decades the country has been considered a tax haven.

Why should we care?

At the end of 2015, The Centre for Research on Multinational Corporations (SOMO), an independent, non-profit research organization based in the Netherlands, released a press release (in Dutch) addressing what the Dutch presidency’s goals and concerns should be. Despite rhetoric amongst Dutch officials, there is little to prove that tax avoidance will be tackled.

During the next few months, it will be essential that the Netherlands steps up to the plate, particularly when it comes to making country by country reporting (CBCR) subject to public disclosure in the EU.

Why is this important?

Public CBCR would force multi-national corporations (MNCs) to disclose basic information regarding their finances about every country in which they do business. This would include taxes paid, revenue, number of employees, profit, etc.

CBCR is of unparalleled importance when it comes to assessing whether MNCs contribute to the economic well-being of the countries in which they operate. Corporate tax avoidance and profit shifting complicate and weaken the economic situation in other parts of the world by artificially lowering tax obligations, often in jurisdictions that need tax revenue the most. It also makes it difficult for investors who value economic stability. Without CBCR, they can’t verify that a company isn’t distorting its bottom line or taking excessive risks.

Last July, the European Parliament made it clear that they expect firm steps toward transparency, when it voted in favor of a requirement for MNCs to publicly report financial information on a country-by-country basis, as part of a larger initiative known as the Shareholders Rights Directive (SRD). Now, the Parliament, along with the European Commission and Council of Member states, will negotiate a final draft of the SRD.

The Organization for Economic Cooperation and Development (OECD) has also spoken in favor of CBCR, but failed to commit to public reporting, a major factor in determining the overall effectiveness of the transparency measure.

Although challenging, it is the duty of the Council presidency to put aside any national agenda and work for what is beneficial to the EU as a whole. This could be the perfect opportunity for the Dutch government to right the wrongs that have been committed within their borders, and advocate for an SRD that includes public CBCR.

What are the consequences?

According to this Social Europe article

CBCR would level the playing field for individuals as well as smaller, domestic-level corporations.

Illicit financial flows take an especially large toll on the economies of developing countries. The loss of large sums of money affects developing nations much more dramatically because they are losing funds that would have otherwise gone toward the drivers of development, like roads, schools, and hospitals.

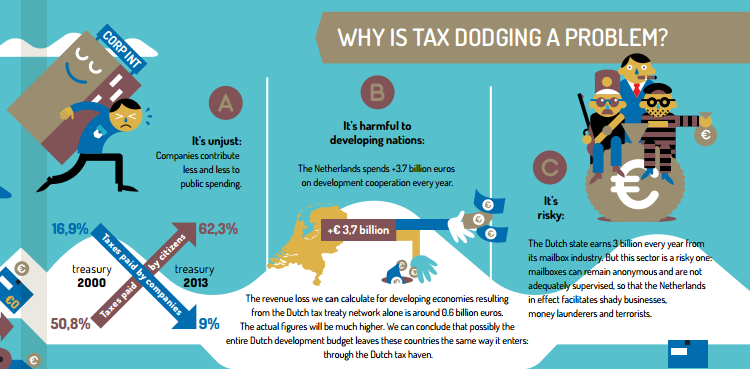

SOMO created an excellent graphic that illustrates the various issues generated by Dutch tax policy. You can check it out in its entirety here.

During the Netherlands’ presidency, priority must be given to tackling the inequality rampant in their taxation system, which will in turn help achieve a second goal of presenting themselves as a nation that can be a credible leader.

There is no denying the Netherlands’ status as a tax haven. The question is whether they will use the next six months with the presidency to advance their own agenda, or to accomplish what is best for the EU and the broader global community.