The IKEA conundrum

October 4th, 2010

October 4th, 2010

IKEA is a private company. It does not need to publish an annual financial statement ion the form as a quoted multinational corporation. And it doesn’t. But it has (I think for the first time) published a limited annual report. That’s the good news. The bad news is it does not tell us much.

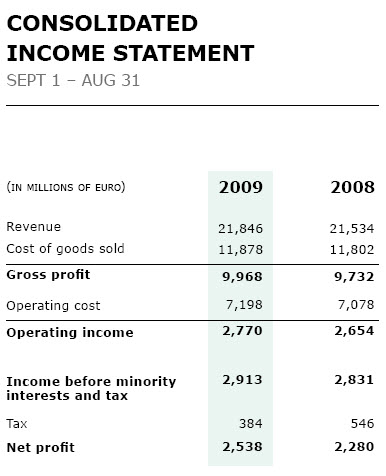

This is the profit and loss account:

And this is its tax note:

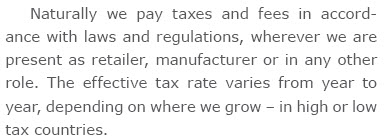

And for the sake of the record, here’s the geographical spread of trading:

So, IKEA makes 79% of its sales in Europe and 62% of its purchases in Europe. It’s a European dominated business then.

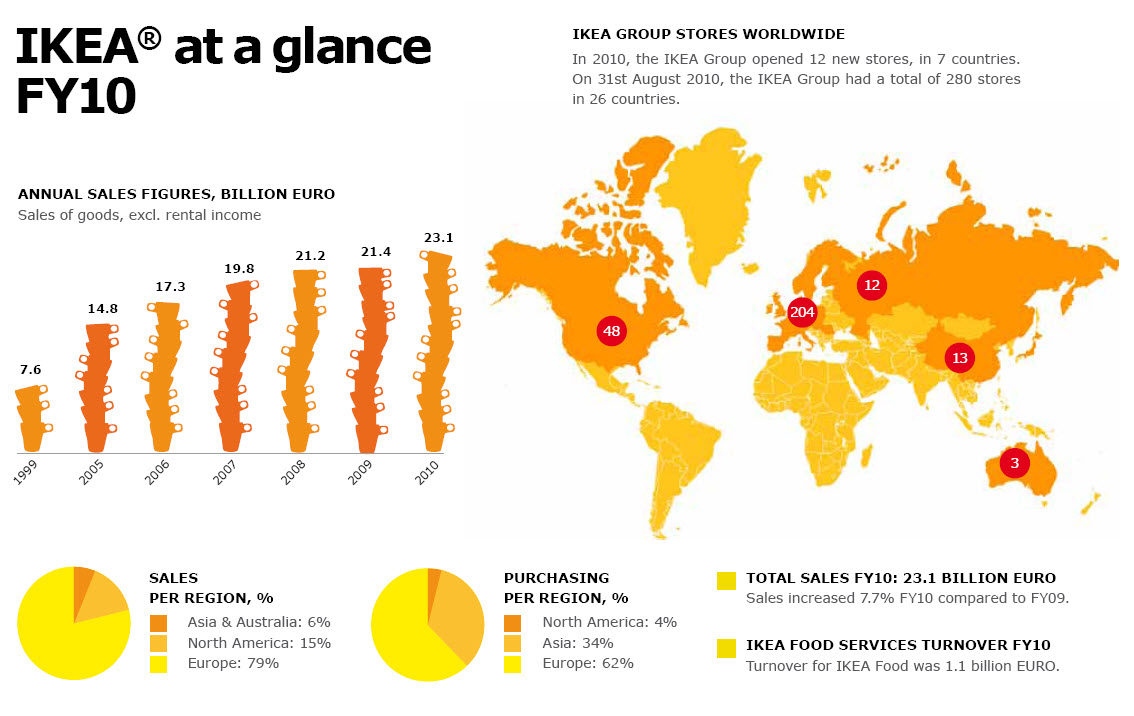

When last I checked the plot of corporate tax rates in the EU was:

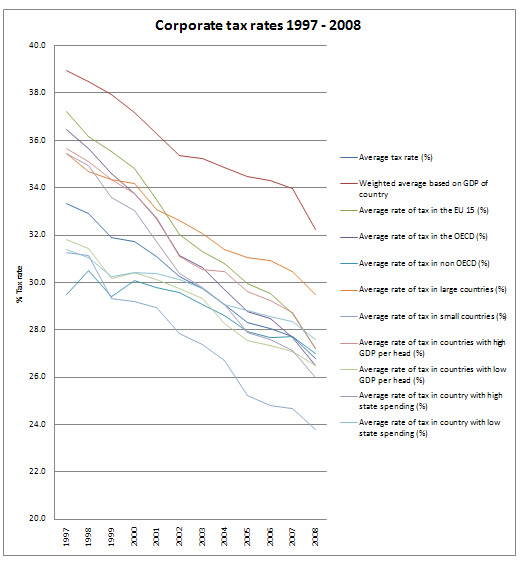

To prevent any doubt, a more complex analysis is as follows (all data based on KPMG information, with rates incidentally being largely fixed in 2009):

That’s a lot of data, but you get my point I hope – tax rates may be falling but something around 27% is the norm without weighting for GDP.

And yet IKEA has a tax rate of 13.1% in 2009 and 19.3% in 2008. We have no idea whether these are current rates either: if the provision includes deferred tax the current rate may be lower, but we can’t tell.

All we can wonder is why the published rate IKEA records is so low compared to the rates available in most countries in which IKEA must actually make its profit.Without country-by-country reporting we can’t answer that.

It is, of course, a reason why we need country-by-country reporting. Only when a company reports its sales, costs, profit and tax on a country-by-country reporting basis can be know that it is really paying its way where it should. I’m not saying IKEA isn’t. But I am saying the published data looks hard to reconcile with the rates data noted above, and country-by-country reporting data would let me resolve the conundrum.

I wonder if they’d like to republish on this basis?