Tax Information Exchange Agreements really do not deliver

July 28th, 2009

July 28th, 2009

I hope people have noted I’m not a great fan of Tax Information Exchange Agreements. The basic reason is that they are virtually impossible to use. As the standard TIEA makes clear, a TIEA request must provide or state:

(a) the identity of the person under examination or investigation;

(b) what information is sought;

(c) the tax purpose for which it is sought;

(d) the grounds for believing that the information requested is held within the jurisdiction of which request is made;

(e) to the extent known, the name and address of any person believed to be in possession of the requested information.

The reason for the low number of information requests becomes obvious immediately. In many cases these hurdles are insurmountable because of the secrecy in the target jurisdiction.

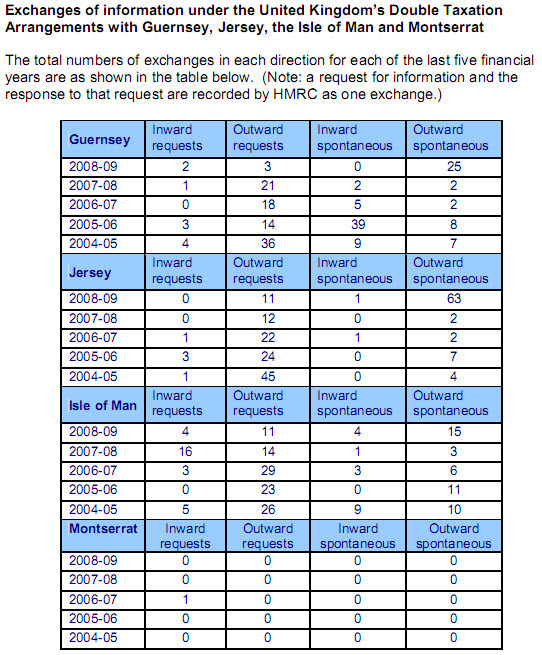

Some practical evidence always helps illustrate this. Private Eye recently made Freedom of Information requests in the UK regarding information exchange between the Uk and four of its secrecy jurisdictions with which it has had agreements (if not TIEAs) for some time. They have now shared the results with me, and they are as follows:

Several things become immediately apparent. Firstly, the number of information exchange requests has fallen steadily from 2005 to 2009 (107 to 25 – excluding ‘spontaneous requests’). This is a sure sign of how limited are the resources the UK can now dedicate to enquiry work. It is also clear indication of how little follow up has been done to the 2007 tax disclosure / amnesty.

Second, the tiny volume proves how meaningless it is to say that these types of arrangement create financial transparency. Over 40,000 people using these jurisdictions voluntarily disclosed involvement in tax evasion in these locations in the 2007 tax amnesty in the UK. It is clear that information sharing did not contribute to that process.

Third, unsurprisingly the flow it to the havens and not from them.

Fourth, spontaneity has increased (I presume European Union Savings Tax Directive driven – but I cannot be sure) – but this is a different type of exercise and so should not be confused with targeted work.

Last, as expected Jersey leads the pack with the isle of Man and Guernsey following, and Montserrat insignificant. The volume of funds held follows the dame order, unsurprisingly and is good indication of the likelihood of tax risk.

But most important – how depressing that procedures that so clearly offer so little are being promoted by the OECD as the solution to the tax haven / secrecy jurisdiction problem when it is so obviously clear that automatic information exchange must be the answer.