Tax Havens at the Core of the Greek Crisis

November 26th, 2010

November 26th, 2010

Reposted from the TJN blog:

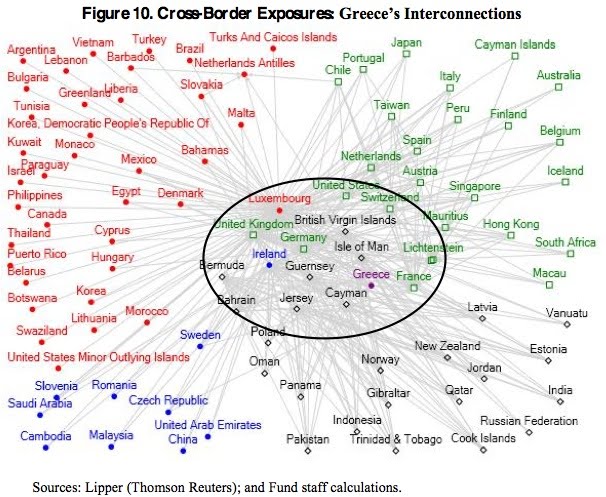

Sometimes a picture speaks more clearly than words can. Now, courtesy of something that FT Alphaville has just pointed out, we bring you this:

Look at all those jurisdictions inside the black circle. All secrecy jurisdictions, except for France and Germany. Widen the circle a little, and look at the jurisdictions that would appear, especially in that cluster in the top right: Mauritius, Singapore, Austria and the Netherlands. Push it a little further, and you get Singapore and Hong Kong. All secrecy jurisdictions. The accompanying text in the relevant IMF report, from where this graph comes, says:

“An illustration of Greece‘s interconnections in cross-border funding flows reveals why funding strains in Greece in the first half of 2010, despite being by itself small, might have translated into pressures on other Euro Area peripherals. Recall that banking exposures to Greece were relatively small in the context of banks‘ balance sheets; yet, concerns about the strength of balance sheets and the ability of other Euro Area peripheral countries with fiscal and financial vulnerabilities to finance themselves increased as the Greek situation worsened. Using the funds‘ data, Figure 10 presents four clusters (i.e., countries that together form more of a closed system), centered around a set of core connections that are closely linked to Greece: (i) a red cluster of countries with access to funds domiciled in Luxembourg; (ii) a black cluster with access to funds domiciled in the offshore centers of British Virgin Islands, Jersey, Cayman, Guernsey, and the Isle of Man; (iii) a blue cluster with Ireland at the core; and (iv) a green cluster of the U.S. with several key European and other countries. Greece is interconnected with each of the central nodes of these clusters. This close interconnection across other core countries suggests why asset re- allocations and flows might have been large systemically, with potentially significant impact on countries such as Ireland.”

Contagion: the tax havens lie right at the heart of it. (And you can be sure that the “United States” will have heavily featured Delaware, a tax haven inside the U.S. that has been the securitisation jurisdiction of choice, as explained below; the “United Kingdom” means the City of London, that state within a state that is arguably the world’s most important offshore jurisdiction.) See more on that here.

Half a century ago, the global financial architecture was, as a result of lessons learned from the Great Depression, heavily fragmented and flows of capital across borders were quite tightly constrained by capital controls. The quarter century after the Second World War (well, from 1947-8ish) was known as the “golden age” of capitalism: an era of broad-based, stable growth, with few financial crises. The rise of tax havens and the interrelated phenomenon of the offshore Euromarkets coincided with the end of the golden age and the disruption of these happy trends. From the 1970s onwards, incomes for ordinary folk have stagnated while those at the top have soared. Tax havens, or secrecy jurisdictions, played a major role in this.

One of the key aspects was that the offshore finance, by making flows of international finance more “efficient” (in January TJN will be producing a lot of material showing just how inefficient this all was), also had the effect of making the world’s economies more interconnected. Unregulated capital could now flow, unhindered, to tax havens and mass there, protected from outside interference, and from these protected platforms they could mount large-scale and co-ordinated speculative attacks against currencies, for example, often with terribly destabilising effects. The countries that liberalised their economies the most seem to have been the most troubled, while those that financed themselves more from local markets tended to do better. One result of this “efficient” interconnected financial economy, it seems, was an explosion in the number of financial crises.

And the new IMF report illustrates exactly that. It notes:

“The vast majority of global finance is intermediated by a handful of large, complex financial institutions (LCFIs), which transact on a few payments and settlements systems and operate out of a small set of countries that serve as global common lenders and borrowers. . . . pervasive interconnections can result in a rapid transmission of adverse shocks across the global financial system . . . The transmission of shocks and the spillover of policies and financial conditions occur largely through these core economies.”

The paper looks at both banks and “non-banks” – the strange creatures that roam that largely offshore zoo that is known as the Shadow Banking System. The non-bank sector, as the IMF explains, is very offshore-like:

“The nonbank entities [exhibit behaviour that] has been fueled in part by the desire to avoid regulations”

Now the offshore system and the so-called shadow banking system are different, albeit heavily overlapping things. As we noted recently, shadow banks are those institutions that escaped from the social contract. They did it, very substantially, by using offshore jurisdictions.

The IMF continues, noting that we should focus not just on the jurisdictions, but on the private players:

“By virtue of their global reach, these LCFIs can reap diversification benefits. At the same time, they are also “super spreaders” of crisis and losses in stressful times; during the recent global crisis, 18 institutions accounted for more than half of the $1.8 trillion losses reported by the world‘s banks and insurance companies.”

The non-bank fund industry, it notes, increased in size from $11.7 trillion to 26.8 trillion from 2002 to 2009. Phew. Offshore played a central part in puffing all this candy floss money up so fast: without regulations (such as reserve requirements), money grows so much faster. And then there is this:

“The rise of offshore financial centers gives the impression of a seemingly dispersed or decentralized global financial architecture with many centers. But the analysis of holdings and cross- border exposures in the funds data reveals a core group of centers or nodes, such as the United States, United Kingdom, Luxembourg, and France, around which the offshore centers are clusters and to which they channel funds sourced globally.

Several things need pointing out here. First, the way this is phrased suggest that the IMF doesn’t undestand what an offshore centre is. It seems to think Luxembourg is onshore – which it is most definitely not. We believe that Luxembourg is the world’s second biggest secrecy jurisdiction, after the United States. This reminds us of a similar confusion we noted at the Bank for International Settlements:

“The most common SPE jurisdictions for European securitisations are Ireland, Luxembourg, Jersey, and the UK. . . . The most common jurisdictions for US securitisations are the Cayman Islands and the state of Delaware. The onshore (Delaware) versus offshore (Cayman) decision will generally be driven by factors outlined in the previous section.”

The BIS, too, is wrong. Every single one of these jurisdictions is offshore. As regards Luxembourg, look at this picture:

Offshore Luxembourg is clearly a massive player in this whole game.

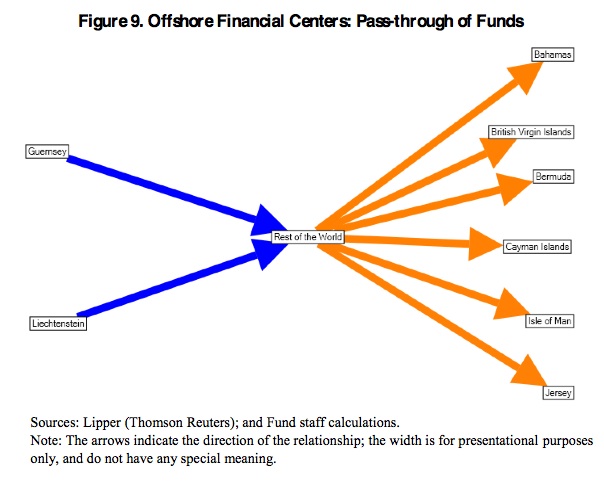

And now, another picture. But first, an explanation:

“Figure 9 illustrates clusters of offshore centers that together pass-through funds (i.e., receive and distribute funds to the rest of the world). Guernsey and Liechtenstein are distributors of funds to the core nodes, whereas the Bahamas and Bermuda are more collectors of funds for the clusters of off-shore centers.”

These are the conduits: transmission belts for financial contagion. Even though Greece and Ireland are pretty small countries, they are jeopardising all of our futures, partly because of the leverage at the heart of these structures – leverage that offshore finance has also helped to foster, it has to be said. And the scale of this thing is vast. As the IMF also says:

“A core set of countries and financial systems are at the center of global finance. These nodes intermediate close to two-thirds of claims on the rest of the world.”

But Professor Ronen Palan of the University of Birmingham notes something absolutely crucial about all this:

“Why do we really need this level of ‘interconnectdness’ ? There does not seem a logical reason for so much money to flow back and forth through so many jurisdictions. The IMF does not ask why it takes place.

A very good question. We have only started to discern the dim outlines of all this. For more on why tax havens were utterly central to the financial crisis, click here.

(Updates: some forensic details about offshore Ireland; Simon Johnson on Ireland’s ghost economy.)