President Mbeki takes issue of illicit financial flows on a U.S. roadshow

February 24th, 2016

February 24th, 2016

What if every time you donated a dollar to help an impoverished community, two dollars left the very same place?

Alarmingly, this isn’t far from the reality of the world economy.

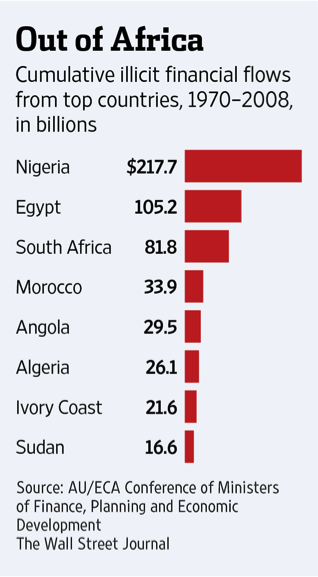

According to a report led by former South African President Thabo Mbeki on behalf of the UN Economic Commission of Africa (UNECA) High Level Panel on Illicit Financial Flows from Africa, nearly $60 billion flows out of the African continent through questionable, illicit means every year. This is twice the amount of money flowing in as aid annually. Often, money leaving developing countries illicitly ends up right back in banks in Europe and the U.S.

The Mbeki Report touches on this very issue:

It is somewhat contradictory for developed countries to continue to provide technical assistance and development aid (though at lower levels) to Africa while at the same time maintaining tax rules that enable the bleeding of the continent’s resources through illicit financial outflows.

Since the initial release of the report in January 2015—after virtually unanimous endorsement among African Union (AU) states at the AU Summit in Addis Ababa, Ethiopia—the issue of illicit financial flows (IFFs) has leapt onto the world stage. The Mbeki Report revealed, in explicit terms, the magnitude of money Africa is losing every year to IFFs, while examining the correlated issues that contribute to this problem, such as taxation, corruption, function of the corporate sector, and recovery of stolen assets.

Because the report was made accessible to anyone and everyone, citizens across countries in Africa were made aware of the toll IFFs are taking on their economies, which is a testament to the importance of transparency at all levels as a successful tool for change. Quite impressively, in the last year, citizens from various African countries have come together on this issue.

Perhaps the biggest popular mobilization campaign, which launched last year in Nairobi, is the Stop the Bleeding campaign, formed by five African NGOs, including FTC member Tax Justice Network – Africa. It aims to “broaden the conversation on illicit financial flows beyond specialized circles [by] mobilizing ordinary people and grassroots social movements who are most affected by the problem.”

As decidedly important as inter-African support and cooperation may be, it is not nearly enough to solve the problem; international cooperation is imperative to enact change.

This is why President Mbeki recently visited the United States as a segment of his broader global advocacy tour. Visiting Washington, D.C. and New York City, he met with various groups, including officials from the U.S. government, the IMF, World Bank and the International Diplomatic Corps. He also delivered a speech to the Economic and Social Council (ECOSOC) of the United Nations and consulted civil society organizations.

You can watch some highlights from his trip here, via the South African Broadcasting Corporation:

Mbeki has emphasized that there is a clear, although by no means simple, set of solutions to the issue of IFFs from Africa. What is necessary is:

The report calls for, “common but differentiated responsibilities’ for developing countries (p46) such as a transitional period toward reciprocal Automatic Exchange of Information, during which they receive information automatically even though they are not able to send any information back.” Developing countries need room to grow and progress to the level where they are able to present that type of information on the global stage, and they should not be excluded from the conversation because they do not have the facilities to report immediately.

More steps need to be taken to create transparency from an African perspective, rather than what works best for OECD countries.

Africa needs all the resources it can corral to work towards lasting progress, and IFFs create a serious obstacle in achieving sustainable development. As President Mbeki has said, the only way IFFs will come to an end is when “all of us act in concert.” President Mbeki is set to follow up his American tour by continuing his advocacy work in Europe, where he will “undertake further consultations with the European Union (EU), the Organization for Economic Co-operation and Development (OECD) and members of the British government among others.”

If the global community has a genuine interest in working with developing countries to create sustainable development, our first priority should be changing the policies that tolerate illicit financial flows.