The Panama Papers – what they mean and why they are important for Africa

June 8th, 2016

June 8th, 2016

In April and May of 2016, the International Consortium of Investigative Journalists (ICIJ) made public the largest ever investigation into international fraud, exposing a cast of characters who use offshore companies to facilitate bribery, arms deals, tax evasion, financial fraud and drug trafficking. The revelations dubbed the ‘Panama papers’ has brought to the fore systemic corruption and failings of the global financial and legal system that has allowed individuals and companies to exploit loopholes and gaps in legislation and regulations at the expense of, in many cases, poor countries.

Why is this important?

The Panama papers are important for several reasons. First, they reveal the breadth and depth of ‘legal corruption’ taking place within the global financial and legal framework allowing individuals and companies to move monies across the globe irrespective of how they have been obtained. Second, they reveal that issues of corruption; tax avoidance; tax evasion; illicit financial flows (IFFs) can no longer be an ‘African or developing country challenge’. The evidence thus far confirms complicit actions from European and American based companies in moving funds to jurisdictions with high secrecy laws. Third, the data and evidence presented in the Panama papers further demonstrate the exploitation by individuals and companies of weak legislative frameworks in developing countries as well as the deep rooted corruption that transcends the national and international architecture.

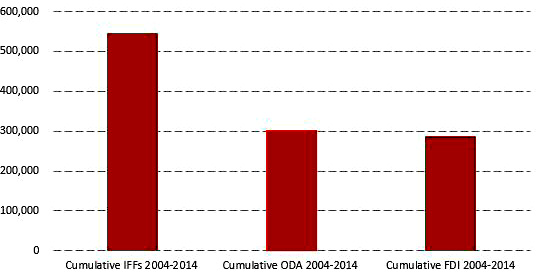

The Panama papers are important for Tax Justice Network Africa (TJN-A) because they confirm long-held views of a complicit and flawed international financial and legal architecture in moving resources from Africa to tax havens; and off-shore and high secrecy jurisdictions[i]. These monies are often associated with tax avoidance[ii]; tax evasion[iii]; illicit financial flows (IFFs)[iv]; fraud; and corruption, which leave the continent at the expense of African citizens who lack access to basic services such health, education, and water and sanitation. This subsequently impacts governments’ ability to finance their countries’ development and growth. The impact of outflows due to IFFs on TJN-A member countries is illustrated in Figure One below.

Figure 1: Countries with TJN-A member- organisations (total):

Source: TJN-A based on OECD CRS database; GFI IFF database; and UNCTAD statistical database

Between 2004 and 2014, TJN-A member countries lost over USD 50 billion to IFFs. To put this in perspective, over the same period, TJN-A member countries received USD 30 billion in Official Development Assistance (ODA) and USD 28 billion in Foreign Direct Investment (FDI). This is to say that over a ten year period, TJN-A member countries lost approximately twice as much to IFFs than they received in ODA and FDI. This is indeed quite a significant outflow of resources especially considering most TJN-A member countries are low income countries with high incidences of poverty and inequality

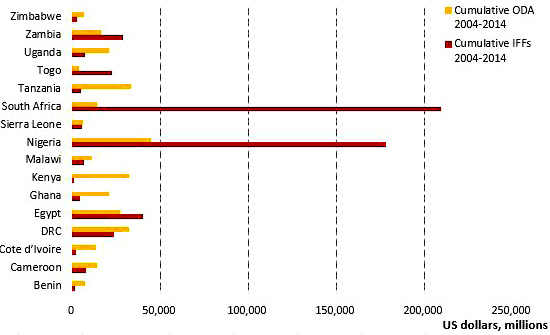

A closer examination of why the Panama papers are important is shown in Figure Two below. Consistent with the second release of data by ICIJ and TJN-A’s press release the highest registered number of off-shore entities also have the highest inflows through IFFs.

Figure 2: IFFs v ODA 2004-2014 for countries with TJN-A member- organisations (total):

Source: TJN-A based on OECD CRS database and GFI database

From the figure above, it is worth noting the individual TJN-Amember countries affected by outflows by IFFs. Countries like Nigeria, South Africa, Togo, and Zambia have lost more to IFFs than they have received in ODA between 2004 and 2014. This is of concern given the levels of poverty experienced in these countries despite their economic growth and GDP statistics. As Figure Two suggests, the issue of IFFs needs to be addressed both at the global and national levels especially given the countries with the highest IFFs also have the highest number of registered off- shore companies as per the latest Panama leaks.

What is TJN-A doing?

The Panama papers come at a time when TJN-A is at the forefront of several campaigns geared towards to raising awareness on IFFs and the need for a more transparent and efficient global financial and legal architecture. The ‘Stop the Bleeding’ campaign aims to stop IFFs from Africa. In 2016International Tax Justice Academy (ITJA) and African Parliamentarian Network on Illicit Financial Flows and Tax ( will have IFFs as a major theme and bring together our member countries to ensure the issues of IFFs are at the fore for discussions and policy recommendations.

Notes:

[i] Tax haven – Jurisdictions whose legal regime is exploited by non-residents to avoid or evade taxes. A tax haven usually has low or zero tax rates on accounts held or transactions by foreign persons or corporations. This is in combination with one or more other factors, including the lack of effective exchange of tax information with other countries, lack of transparency in the tax system and no requirement to have substantial activities in the jurisdiction to qualify for tax residence. Tax havens are the main channel for laundering the proceeds of tax evasion and routing funds to avoid taxes. Secret Jurisdiction – Secrecy jurisdictions are cities, states or countries whose laws allow banking or financial information to be kept private under all or all but few circumstances. Such jurisdictions may create a legal structure specifically for the use of non-residents. The originators of illicit financial flows may need to prevent the authorities in the country of origin from identifying them (e. g. if the money is the proceeds of tax evasion), in which case the flow will be directed to a secrecy jurisdiction. Because those directing IFFs seek out low taxes and secrecy, many tax havens are also secrecy jurisdictions, but the concepts are not identical.

[ii] Tax avoidance – The legal practice of seeking to minimise a tax bill by taking advantage of a loophole or exception to tax regulations or adopting an unintended interpretation of the tax code. Such practices can be prevented through statutory anti-avoidance rules; where such rules do not exist or are not effective, tax avoidance can be a major component of IFFs.

[iii] Tax evasion – Actions by a taxpayer to escape a tax liability by concealing from the revenue authority the income on which the tax liability has arisen. Tax evasion can be a major component of IFFs and entails criminal or civil penalties.

[iv] Illicit Financial Flows (IFFs) – Money that is illegally earned, transferred or utilised. Illicit financial flows (IFFs) are illegal movements of money or capital from one country to another. Global Financial Integrity (GFI) classifies this movement as an illicit flow when the funds are illegally earned, transferred, and/or utilised. These funds typically originate from three sources: commercial tax evasion, trade misinvoicing and abusive transfer pricing; criminal activities, including the drug trade, human trafficking, illegal arms dealing, and smuggling of contraband; and bribery and theft by corrupt government officials.