Who is paying for Jersey to be a tax haven?

November 7th, 2011

November 7th, 2011

The reason why places like Jersey became tax havens was to raise tax revenue from third parties. The tax revenues raised were, in effect, export earnings that kept their economies afloat.

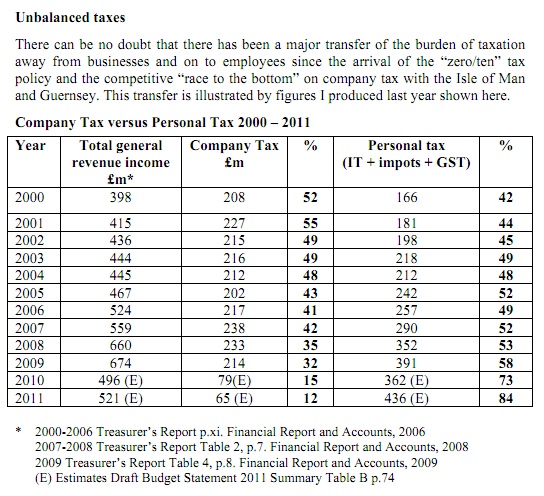

Deputy Geoff Southern in Jersey has tabled an amendment to the current Jersey budget that shatters the myth that this is still the case. As his amendment says:

Geoff is right to acknowledge there is a race to the bottom in Jersey, Guernsey and the Isle of Man. Promoted by the pinstripe infrastructure of lawyers, accountants and bankers, the pernicious influence of these groups has driven these three jurisdictions on a destructive path towards shattering their tax base by eliminating corporate taxes for their clients.

The result is all too apparent. The tax burden has shifted dramatically from businesses using Jersey as a tax haven to the local population who are now paying for the privilege of hosting the tax abuse industry whilst at the same time their economy is facing ruin as local politicians realise they have no idea how to plug the continuing deficits they face and are now suggesting plundering the rainy day fund – a sure sign they are on the slippery slope to running out of money, as I have long predicted.

Geoff Southern has in this case study provided the evidence of what I and the Tax Justice Network have long argued – that the ‘race to the bottom’ in corporate taxes is simply an excuse to shift the tax burden from those able to pay tax (let’s call them the 1%) on to those less able or unable to afford them (again, for simplicity, let’s call them the 99%).

This is happening everywhere but Jersey’s clearly leading the way.

This is what the Tax Justice Network is about.

This is what #occupy is about.

Beating this pernicious process is what re-engagement in democracy should be about for many who feel disenchanted by it.

And this is what beating the exploitative activities of the City of London – the most undemocratic local authority in the UK – has to be about.