UNCTAD: multinational tax avoidance costs developing countries $100 billion+

April 15th, 2015

April 15th, 2015

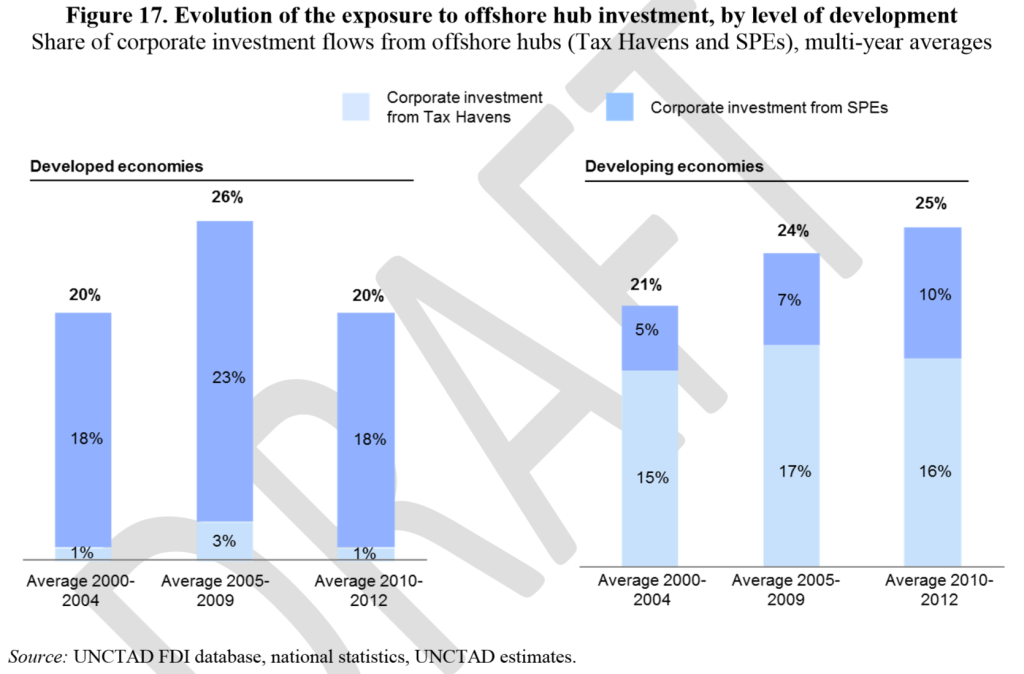

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in revenues due to tax avoidance by multinational enterprises (MNEs), and as much as $300 billion in total lost development finance.

In more detail:

As mentioned, the leakage of development resources is not limited to the loss of domestic tax revenues. Profit-shifting out of developing countries also affects their overall GDP (as it reduces the profit component of value-added, which is what GDP measures). And, as companies shift profits away from the country that is the recipient of the inward investment, they may further undermine development opportunities by reducing the reinvestment of those profits for productive purposes. Applying an average reinvestment rate of 50% to UNCTAD’s estimate of $330 – $450 billion in (after-tax) profit shifting, would suggest a loss in reinvested earnings in the range of $165- $225 billion.

Adding up the tax revenue losses and these lost ‘reinvested earnings’, the total leakage of development financing resources would then be in the order of $250 – $300 billion annually.

Alex Cobham has published a more detailed summary of the report.

UNCTAD has also used a relatively new tax database called the Government Revenue Dataset from the International Centre for Tax and Development (ICTD), which TJN’s Cobham and others have been working with, to provide an approximate baseline for the corporate and other tax contribution of MNEs in developing countries.

The new UNCTAD report is called “a working paper for review and feedback,” so be sure of more such reports and data to come.

One for our permanent reports page.