Reports

November 15th, 2023

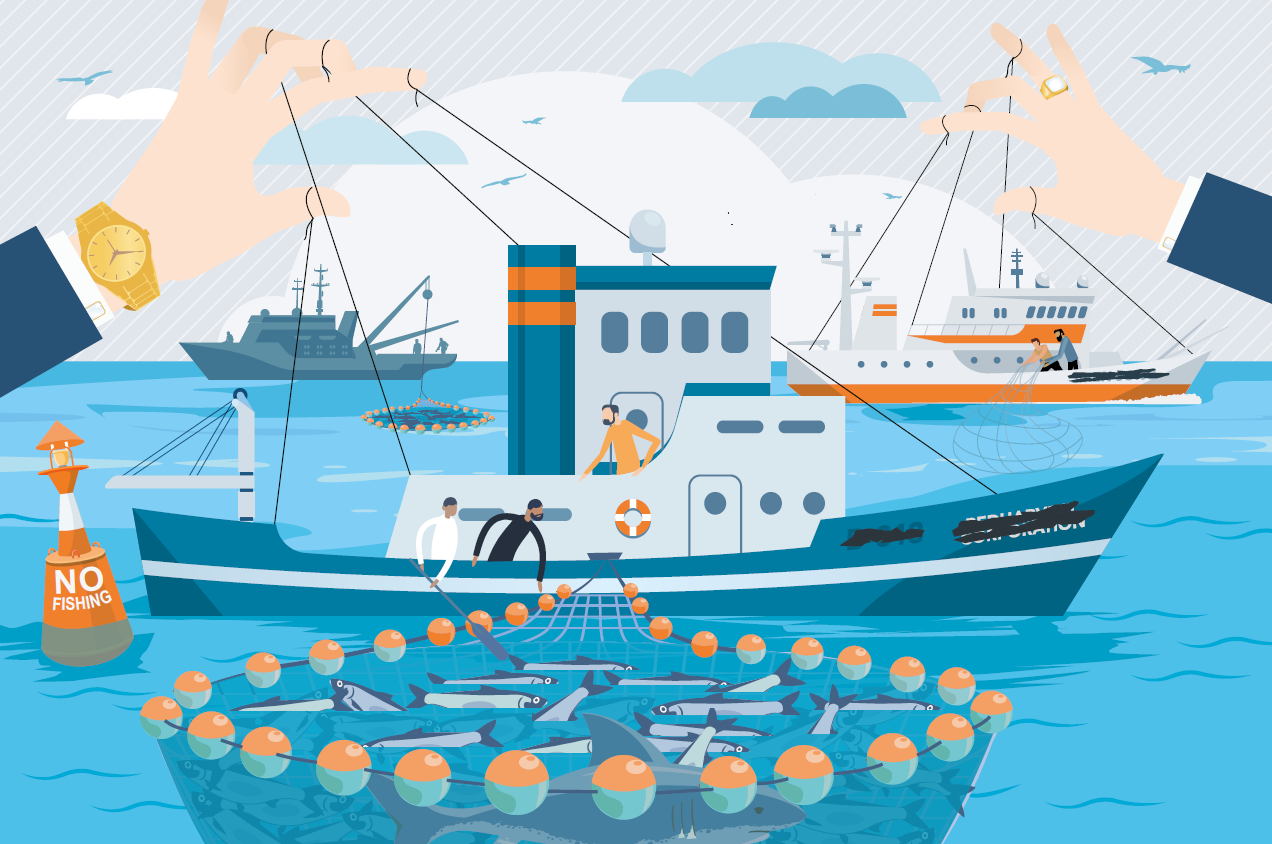

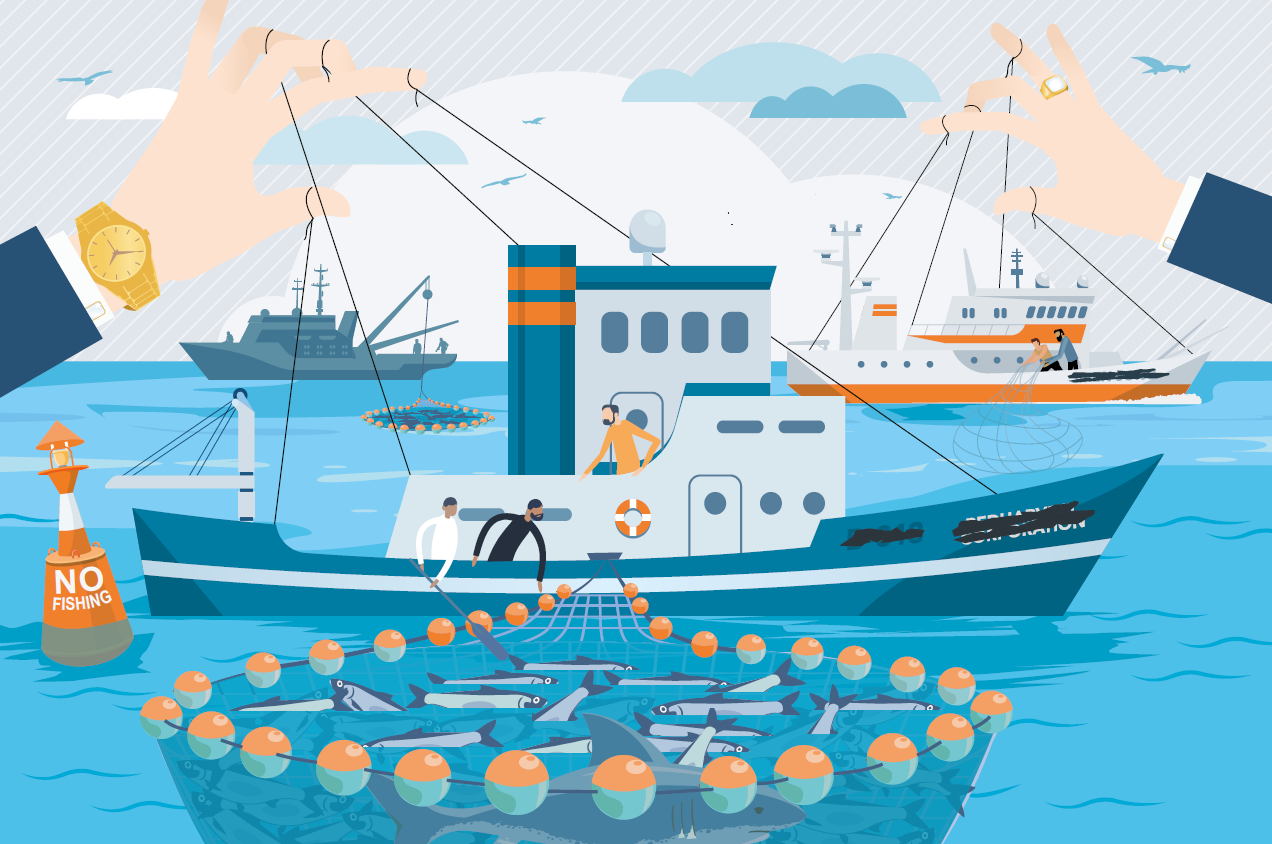

A new report by the Financial Transparency Coalition and members finds that 22.5% of industrial and semi-industrial fishing vessels accused of forced labour were owned by European companies, topped by Spain, Russia and UK firms, although the majority of companies are from Asia, especially Chinese. The report entitled “Dark webs: uncovering those behind forced labour on

Continue Reading

October 26th, 2022

Africa concentrates 48.9% of identified industrial and semi-industrial vessels involved in illegal, unreported, and unregulated (IUU) fishing, 40% in West Africa alone which has become a global epicentre for these activities, according to a new report from the Financial Transparency Coalition and partners – a group of 11 NGOs from across the world. The report

Continue Reading

May 6th, 2021

The vast majority of Covid-19 recovery funds have gone to big corporations instead of toward welfare, small firms, or those working in the informal economy, according to the first major analysis of public bailout funds disbursed in developing countries during the pandemic.

Continue Reading

December 10th, 2020

Por María Eugenia Marano, Juan Argibay y Adrián Falco (Compiladores) Libro presentado durante las VI Jornadas Internacionales: Beneficiarios Finales en Argentina, América Latina y el mundo y su vinculación con la evasión y elusión fiscal, la corrupción y el lavado de activos, llevadas a cabo el 9 y 10 de diciembre de 2020. Descargar el

Continue Reading