December 14th, 2016

Illicit financial flows are constantly in flux, and our understanding of them keeps evolving. Estimating just how much money is lost through corruption, tax evasion, money laundering, and tax avoidance can be a difficult task. But understanding what estimates are out there, and what they mean, shouldn’t be.

Continue Reading

March 23rd, 2016

In the March edition of Taxcast, a podcast produced for the Tax Justice Network: Is the US president really serious about tackling corruption in the finance sector? Are the presidential candidates? Now they can prove it. Bank Whistleblowers United tell us how they can restore the rule of law to Wall Street and avoid the

Continue Reading

February 19th, 2016

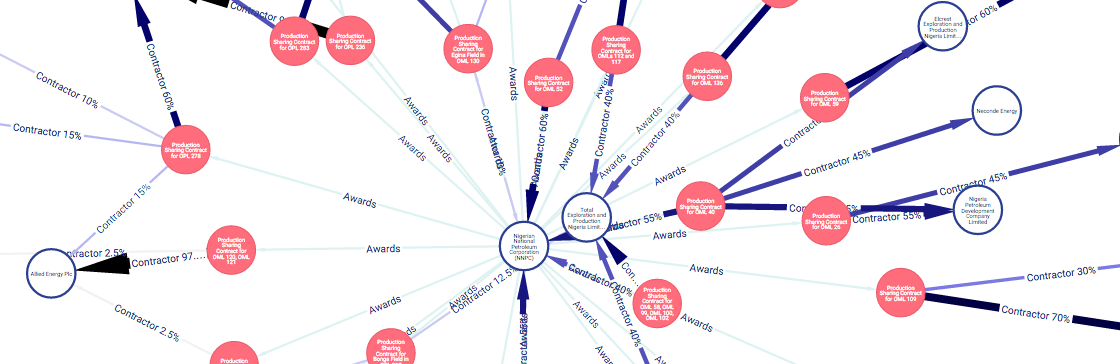

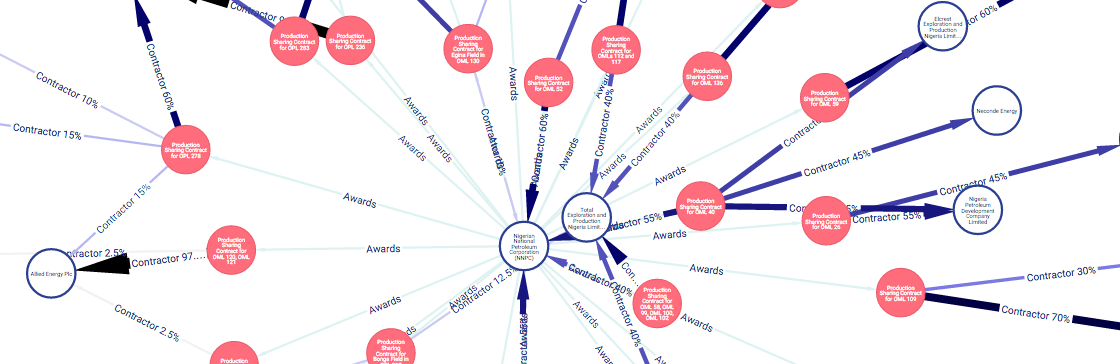

I’m a self-confessed data junkie, but I appreciate that spreadsheets aren’t everyone’s idea of fun. Most people want their digested data packaged up into compelling stories and beautiful visuals. My job here at Global Witness is to do exactly that – tooling up the organisation and its partners so that we can take the troves

Continue Reading

July 16th, 2015

PRESS RELEASE CSOs stand with developing countries that fought hard to deliver an intergovernmental body that could help create equitable tax rules Although a small group of rich countries blocked a plan toward inclusiveness, the amount of pressure developing countries and civil society placed on the Financing for Development negotiations ensures that the spotlight will

Continue Reading