More News

September 30th, 2015

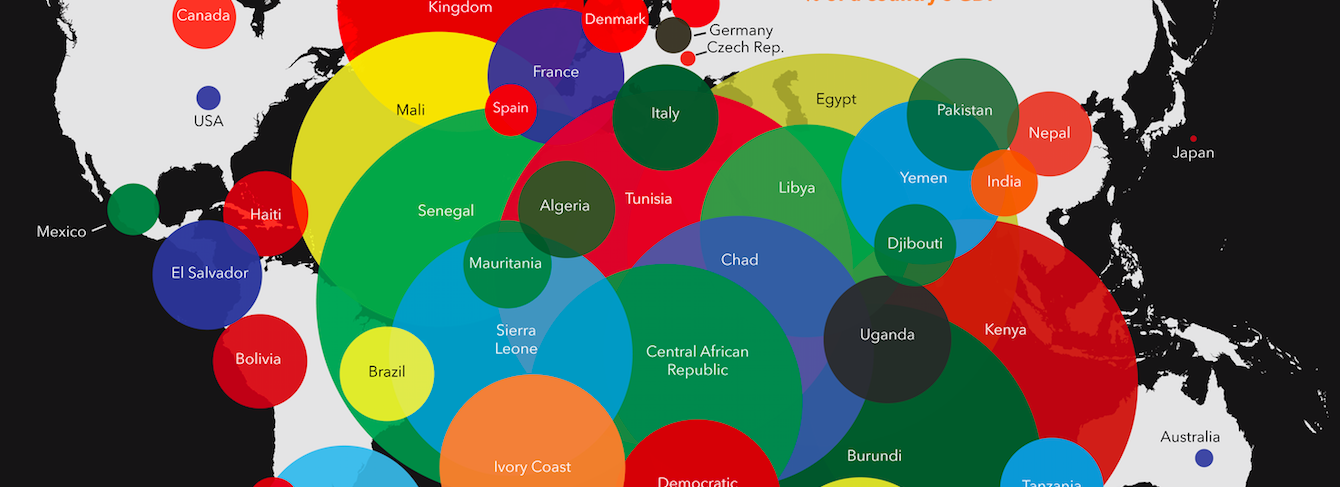

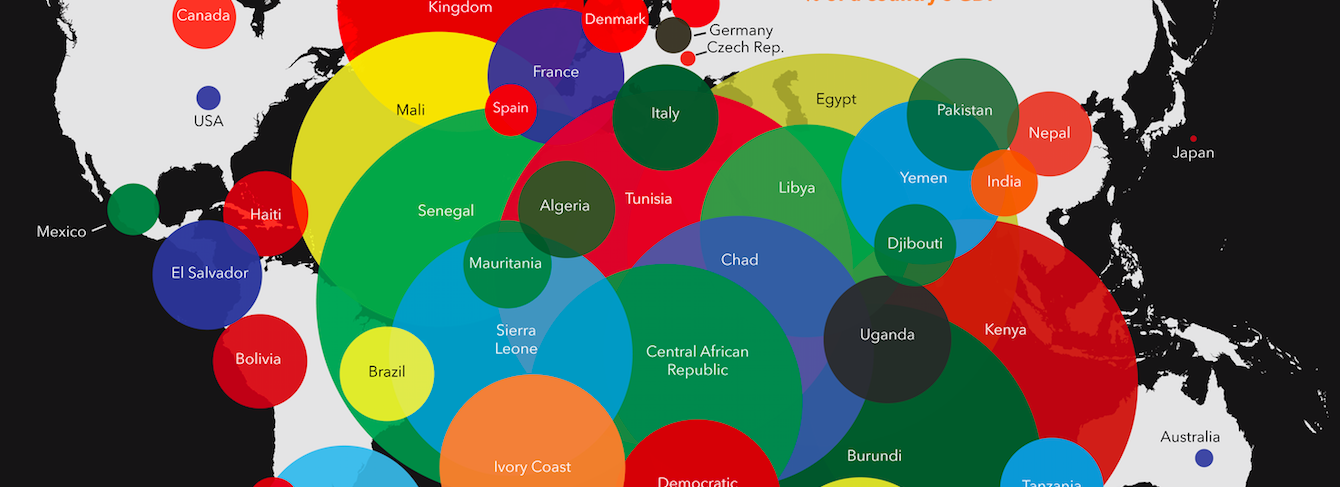

PRESS RELEASE SwissLeaks money connected to Kenya is six and half times higher share of GDP than the money connected to Spain In less than two weeks, G20 Finance Ministers will sit down to dinner, but developing countries won’t even have a seat at the table

Continue Reading

September 26th, 2015

PRESS RELEASE By failing to take concrete action on illicit financial flows and tax dodging in Addis Ababa, questions remain on how domestic resources will be raised Without a globally inclusive standard setting body, developing countries have an uphill battle to realize needed revenues to fund development goals

Continue Reading

September 21st, 2015

Over the past few years, there’s been a great deal of movement on the issue of country by country reporting (CBCR) for multinational corporations (MNCs). The G20 and OECD have developed new reporting requirements as part of their Base Erosion and Profit Shifting (BEPS) initiative, and the European Parliament has gone even further, calling for

Continue Reading

September 17th, 2015

The governments of G8 and G20 countries gave the OECD a global mandate to deliver country-by-country reporting, as a major tool to limit multinational corporate tax abuse, and with particular emphasis on the benefits for developing countries. New evidence shows that – even before its implementation – the OECD standard is likely to worsen existing inequalities in

Continue Reading