February 17th, 2017

How much tax do multinational companies pay in your country? Leading tax justice campaigners (including the Tax Justice Network) and open data specialists are working on helping you find out with their open data for tax justice project. Today they’re publishing a white paper entitled What Do They Pay? which sets out a roadmap for

Continue Reading

February 15th, 2017

Transparency International today said bank regulators need to publish much more information about whether banks are doing what’s required by law to stop money laundering. This would ensure that citizens and businesses can be confident corrupt individuals and organisations, criminals, or terrorists are not using the global banking system. A new report from Transparency International

Continue Reading

February 13th, 2017

It is a fact that the trust laws of some tax havens openly promote illegality. The reality that some tax havens will not enforce foreign laws (e.g. ensuring non-recognition of foreign laws and judgements that favoured legitimate heirs and former spouses) is even publicly advertised by some offshore service providers, not on the deep web

Continue Reading

February 9th, 2017

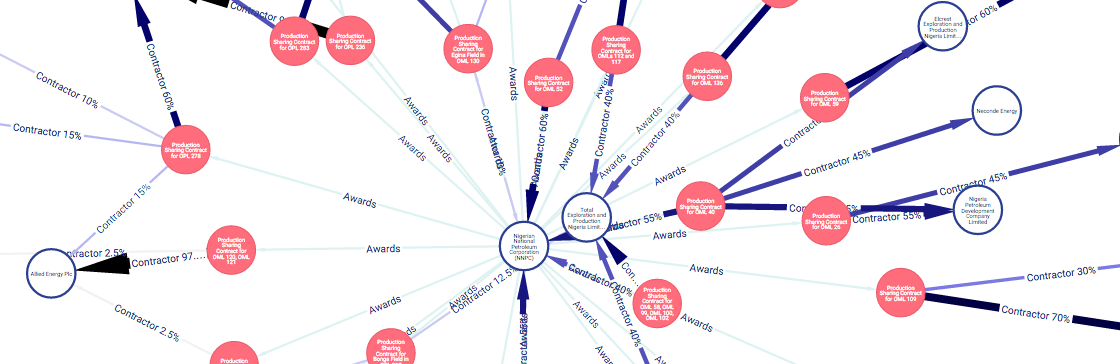

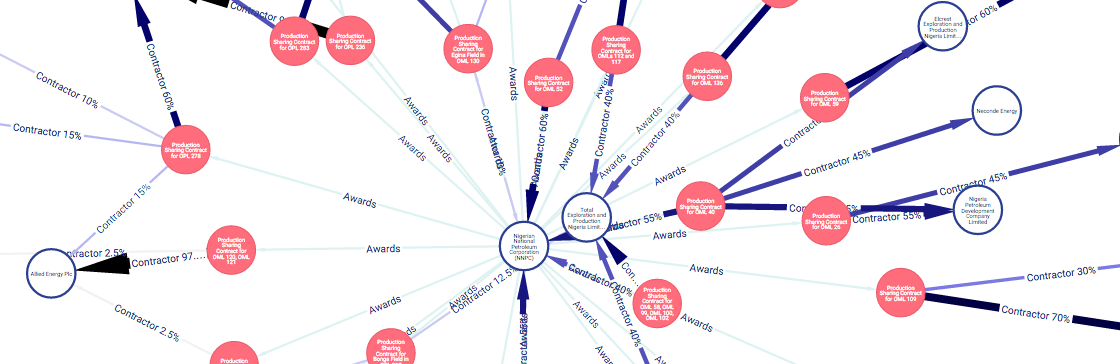

For many people working to open data and reduce corruption, the past year could be summed up in two words: “Panama Papers.” The transcontinental investigation by a team from International Center of Investigative Journalists (ICIJ) blew open the murky world of offshore company registration. It put corporate transparency high on the agenda of countries all

Continue Reading