US officials went looking into high end real estate, they found a lot of question marks

August 8th, 2016

August 8th, 2016

We’ve known for a while that anonymous shell companies have been used to purchase property everywhere from London to Los Angeles. Funneling potentially illicit money into high end real estate has turned out to be an easy way to bypass many of the checks that might be necessary if you moved the money into a bank account. Because in many places you can use a business entity to purchase property, it makes for an easy target, especially when most countries don’t require you to disclose the beneficial, or real, owner of a company.

So, it goes something like this: someone has ill-gotten money they want to hide, but maybe they are afraid to put it into a bank account, which could be frozen if it’s found. With high end real estate markets booming in cities like New York and London, purchasing a flat worth $10 or $15 million could serve the same purpose, but with an even heightened level of anonymity. Since many countries, including the U.S., don’t require companies to disclose their real, or beneficial owner, you can simply buy a property via a company, keeping the real owner hidden behind a comforting layer of secrecy.

And we’ve seen how this is already playing out around the globe.

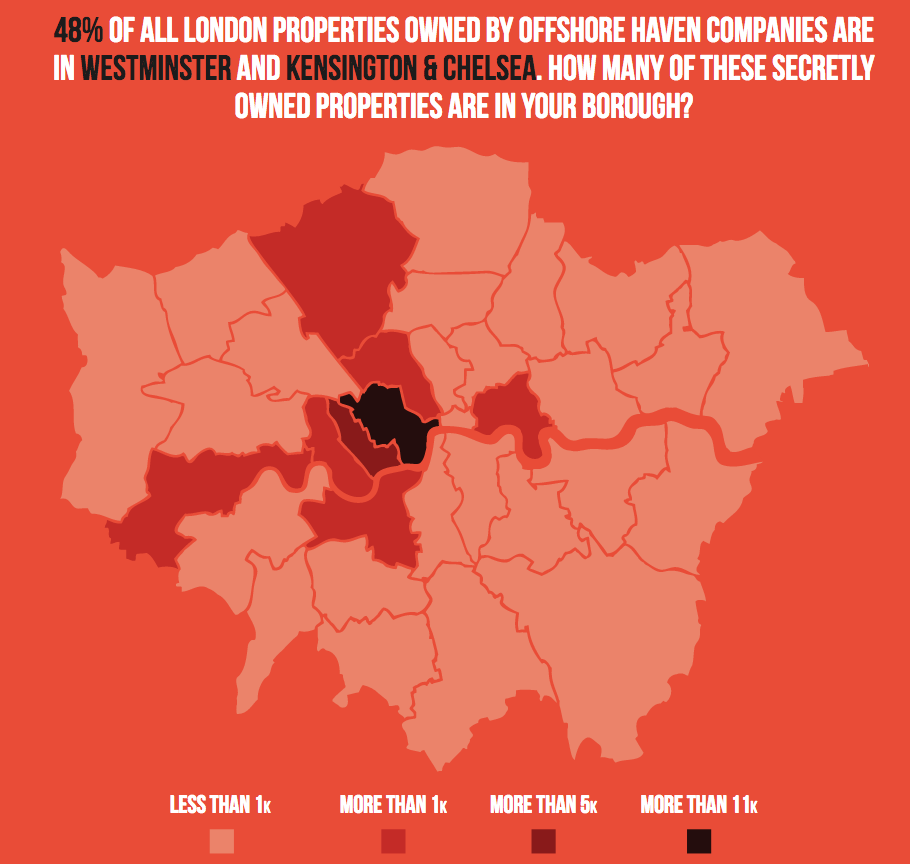

A study published in 2014 by Transparency International UK found that thousands of properties in London were owned via offshore companies.

And a more recent investigation by The New York Times looked at anonymous ownership of real estate in Manhattan’s luxury apartment buildings. The in depth look at the New York City property market returned some interesting results. According to the Times, in 2008 39% of properties sold over $5 million were owned by shell companies that hid the buyer’s identity. By 2014, that number had risen to 54%.

Thanks, in part, to this investigation, along with advocacy work from our colleagues at Global Witness and Global Financial Integrity, the U.S. Department of Treasury announced in January that it would begin a six-month pilot program requiring buyers of high-end real estate in Manhattan and Miami to disclose the real owner(s) of any companies used to make all-cash property purchases. The goal was to see if any of these transactions looked suspicious.

It seems the goal was met.

Now that the pilot program has run it’s course, Treasury officials found more questions than answers, as the preliminary investigation revealed that more than quarter of the all-cash purchases reviewed were deemed to be suspicious. With the test run over, the department plans to expand the program to all five boroughs of New York City, counties to the north of Miami, Los Angeles County, San Diego County, and counties surrounding San Francisco.

From their release:

FinCEN remains concerned that all-cash purchases (i.e., those without bank financing) may be conducted by individuals attempting to hide their assets and identity by purchasing residential properties through limited liability companies or other opaque structures. To better understand this vulnerability, FinCEN issued similar GTOs earlier this year covering transactions in Manhattan and Miami-Dade County, Florida. The GTOs announced today will expand upon the valuable information received from the initial GTOs.

In particular, a significant portion of covered transactions have indicated possible criminal activity associated with the individuals reported to be the beneficial owners behind shell company purchasers. This corroborates FinCEN’s concerns that the transactions covered by the GTOs (i.e., all-cash luxury purchases of residential property by a legal entity) are highly vulnerable to abuse for money laundering.

This is an encouraging development in the fight against money laundering, corruption, and illicit finance, but it also begs one simple question, too: why not just make all companies disclose their true owners publicly?

We’re seeing a growing amount of support for this idea. The UK government has just launched its own register which will feature information on the real, beneficial, owners of companies set up in the UK, while European governments are setting up national-level registers of beneficial ownership information beginning in 2017. Other countries, including Kenya, South Africa, Nigeria and Afghanistan also recently committed to public registers of beneficial ownership information at May’s Anti-Corruption Summit held in London.

If disclosing beneficial ownership information was the law of the land, rather than a retroactive exercise after red flags are raised by NGOs and the media, it would be far easier to catch the flow of dirty money as it’s happening. Unfortunately, the U.S. state of Delaware was recently ranked as the second easiest place in the world to set up an anonymous company, and other U.S. states aren’t far behind, so until the U.S. can fix its own back yard, illicit money will likely continue to flow.

And with other countries tightening up their own regulations, America could very well become the next preferred destination when you have money to clean.